Dig deeper on the latest potential coronavirus treatment

The small biotech company Athersys has roughly tripled in value thanks to the potential that its experimental stem cell therapy can treat a deadly consequence of coronavirus infection. But a closer look at the supporting data suggests investors should be skeptical.

As STAT’s Adam Feuerstein reports, Athersys’ confidence stems from a 30-patient study testing the treatment in acute respiratory distress syndrome, a lung injury that often results from Covid-19. The study met its primary goals of safety and tolerability, and patients who got Athersys’ treatment appeared to have better lung function than those on placebo.

That benefit could be a mirage. Patients in the treatment were younger and had less severe ARDS than on placebo, a disparity that might have skewed the numbers in Athersys’ favor.

Read more.

As STAT’s Adam Feuerstein reports, Athersys’ confidence stems from a 30-patient study testing the treatment in acute respiratory distress syndrome, a lung injury that often results from Covid-19. The study met its primary goals of safety and tolerability, and patients who got Athersys’ treatment appeared to have better lung function than those on placebo.

That benefit could be a mirage. Patients in the treatment were younger and had less severe ARDS than on placebo, a disparity that might have skewed the numbers in Athersys’ favor.

Read more.

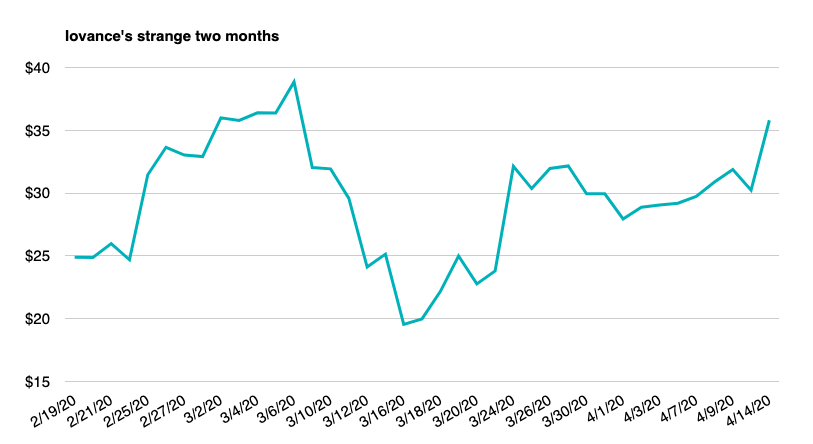

Biotech’s most volatile non-Covid-19 stock

In 2020, billions of dollars have been created and erased by speculation over which companies might develop a treatment for the novel coronavirus. But one of the biotech market’s most unpredictable stories belongs to a company not working on virology at all.

Since the end of February, Iovance Biotherapeutics has gained 57%, dropped 50%, and climbed back another 80%, all without signing a deal, presenting data, or experiencing any of the other usual causes for value fluctuation.

Instead, the cancer-focused company canceled a conference appearance, which led to speculation that it was getting bought. When no deal materialized, shares plummeted. Now they’re creeping back to all-time highs thanks to the letter S.

Yesterday, the company said that researchers from Florida’s Moffitt Cancer Center will soon present data on Iovance’s tumor-killing cell therapy from a trial in non-small cell lung cancer. No one knows anything about that presentation except for the title of its abstract, which begins with the words “Durable complete responses.” As analysts have noted, the use of the plural means there were at least two patients who had no traces of cancer after treatment. And that was enough to add more than $900 million to Iovance’s market cap.

The actual presentation is April 28. Your guess is as good as any as to where Iovance will be trading.

Since the end of February, Iovance Biotherapeutics has gained 57%, dropped 50%, and climbed back another 80%, all without signing a deal, presenting data, or experiencing any of the other usual causes for value fluctuation.

Instead, the cancer-focused company canceled a conference appearance, which led to speculation that it was getting bought. When no deal materialized, shares plummeted. Now they’re creeping back to all-time highs thanks to the letter S.

Yesterday, the company said that researchers from Florida’s Moffitt Cancer Center will soon present data on Iovance’s tumor-killing cell therapy from a trial in non-small cell lung cancer. No one knows anything about that presentation except for the title of its abstract, which begins with the words “Durable complete responses.” As analysts have noted, the use of the plural means there were at least two patients who had no traces of cancer after treatment. And that was enough to add more than $900 million to Iovance’s market cap.

The actual presentation is April 28. Your guess is as good as any as to where Iovance will be trading.

As goes J&J

Johnson & Johnson is the world’s largest and most diversified health care company, so its financial performance — and what its executives say about Covid-19 — carries a lot of weight in uncertain times.

J&J expects business to slow this year due to Covid-19. It cut financial guidance on Monday largely due to a significant drop in elective surgeries which is cutting into its medical device unit.

But for pharmaceuticals, the outlook is pretty good. J&J’s pharma unit posted strong first-quarter results that showed little or no impact from Covid-19. Looking ahead, the health care giant said its pharma unit would dip in the second quarter — as expected — but should rebound and grow in the second half of the year in line with its pre-coronavirus forecast.

A lot of investors expected J&J to pull 2020 financial guidance due to all the uncertainty surrounding Covid-19 infections and how or when the economy might reopen. In a strange way, the confidence shown by J&J to offer a financial forecast for the year, although reduced, is actually a positive sign.

J&J expects business to slow this year due to Covid-19. It cut financial guidance on Monday largely due to a significant drop in elective surgeries which is cutting into its medical device unit.

But for pharmaceuticals, the outlook is pretty good. J&J’s pharma unit posted strong first-quarter results that showed little or no impact from Covid-19. Looking ahead, the health care giant said its pharma unit would dip in the second quarter — as expected — but should rebound and grow in the second half of the year in line with its pre-coronavirus forecast.

A lot of investors expected J&J to pull 2020 financial guidance due to all the uncertainty surrounding Covid-19 infections and how or when the economy might reopen. In a strange way, the confidence shown by J&J to offer a financial forecast for the year, although reduced, is actually a positive sign.

Even for DNA sequencers, Covid-19 is bad news

Illumina, the largest maker of DNA sequencing machines, expects to beat lowered earnings expectations for the quarter, but yesterday withdrew its forecasts for the year because of the Covid-19 pandemic.

The company expects quarterly revenue of $858 million, compared to $846 million in last year's first quarter and its own January projection of $850 million to $855 million.

"Our priority in the midst of this global pandemic is the safety of our employees, partners and customers," said Francis deSouza, Illumina's CEO, in a statement. "We are also committed to ensuring continuity of supply for our customers, many of whom are performing critical clinical testing for patients."

The company's CFO, Sam Samad, warned that second quarter results would be "significantly impacted by Covid-19 related disruption." Samad called this "a temporary disruption that in no way alters the long-term trajectory of sequencing adoption and demand."

It's impossible, he added, to forecast the severity of the current outbreak. The company will report earnings at 5 p.m. ET on April 30.

The company expects quarterly revenue of $858 million, compared to $846 million in last year's first quarter and its own January projection of $850 million to $855 million.

"Our priority in the midst of this global pandemic is the safety of our employees, partners and customers," said Francis deSouza, Illumina's CEO, in a statement. "We are also committed to ensuring continuity of supply for our customers, many of whom are performing critical clinical testing for patients."

The company's CFO, Sam Samad, warned that second quarter results would be "significantly impacted by Covid-19 related disruption." Samad called this "a temporary disruption that in no way alters the long-term trajectory of sequencing adoption and demand."

It's impossible, he added, to forecast the severity of the current outbreak. The company will report earnings at 5 p.m. ET on April 30.

Moderna’s coronavirus vaccine has already minted one millionaire

Moderna Therapeutics is yet to demonstrate that its vaccine for the novel coronavirus can protect against infection, but the buzz — and resulting stock run-up — has already paid off for the company’s head of technical operations.

Moderna’s share price rose about 33% between Feb. 27 and April 3. Over that same period, executive Juan Andres has made seven stock transactions, exercising options to buy a total of 56,706 shares of Moderna for $12.21 each and then selling exactly that amount for an average price of $32.46 per share, according SEC filings. He has netted more than $1.1 million in the trades.

In an emailed statement, Moderna pointed out that Andres's trades were executed automatically under a plan instituted in late 2018. Andres made the transactions under what’s called a 10b5-1 plan, which allows company insiders to program future trades that will take place on a given date or when the stock price crosses a certain threshold.

What’s notable about Andres’s trades, other than the quick succession, is that he held onto exactly zero shares of Moderna in the process. In each case, he exercised his right to buy precisely the number of shares he would then sell, and according to the SEC, he’s no longer a Moderna shareholder at all.

Moderna’s share price rose about 33% between Feb. 27 and April 3. Over that same period, executive Juan Andres has made seven stock transactions, exercising options to buy a total of 56,706 shares of Moderna for $12.21 each and then selling exactly that amount for an average price of $32.46 per share, according SEC filings. He has netted more than $1.1 million in the trades.

In an emailed statement, Moderna pointed out that Andres's trades were executed automatically under a plan instituted in late 2018. Andres made the transactions under what’s called a 10b5-1 plan, which allows company insiders to program future trades that will take place on a given date or when the stock price crosses a certain threshold.

What’s notable about Andres’s trades, other than the quick succession, is that he held onto exactly zero shares of Moderna in the process. In each case, he exercised his right to buy precisely the number of shares he would then sell, and according to the SEC, he’s no longer a Moderna shareholder at all.

More reads

- Novo Nordisk is the latest insulin maker to use Covid-19 to seek goodwill with diabetics. (STAT Plus)

- How one top biotech investor eyes healthcare in a post-coronavirus world. (Forbes)

- Vaccine development becomes reality TV. Can it make viewers rethink pharma? (STAT Plus)

- Biotech VCs steer around Covid-19 obstacles. (Wall Street Journal)

No hay comentarios:

Publicar un comentario