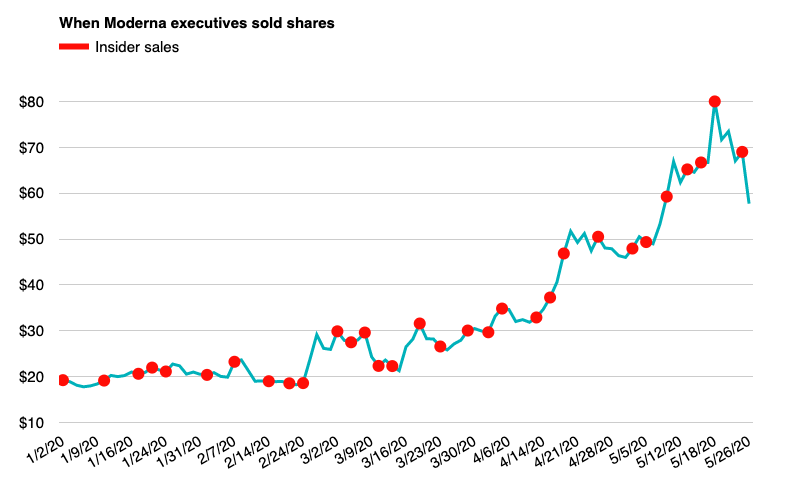

Moderna’s executives have sold $89 million in stock in 2020

In 2020, as Moderna’s share price more than tripled, top executives have dumped 1.7 million shares in pre-planned trades, a perfectly legal endeavor that has a way of irritating common shareholders.

The transactions were done under the SEC’s 10b5-1 program, which allows executives to program future trades in the name of providing liquidity. In Moderna’s case, the transactions happened to coincide with a dramatic increase in valuation tied to the company’s potential vaccine for coronavirus. Moderna’s five top executives have executed 75 transactions this year, nearly three times as many as in all of 2019.

Jay Clayton, the SEC’s chairman, has been advising executives to avoid such stock sales in the midst of the pandemic, which has led to market volatility and inflated the valuations of biotech companies like Moderna. Even if it’s all above board, Clayton said on CNBC, “why would you want to even raise the question that you were doing something that was inappropriate?”

Read more.

The transactions were done under the SEC’s 10b5-1 program, which allows executives to program future trades in the name of providing liquidity. In Moderna’s case, the transactions happened to coincide with a dramatic increase in valuation tied to the company’s potential vaccine for coronavirus. Moderna’s five top executives have executed 75 transactions this year, nearly three times as many as in all of 2019.

Jay Clayton, the SEC’s chairman, has been advising executives to avoid such stock sales in the midst of the pandemic, which has led to market volatility and inflated the valuations of biotech companies like Moderna. Even if it’s all above board, Clayton said on CNBC, “why would you want to even raise the question that you were doing something that was inappropriate?”

Read more.

A startup sets its sight on the two arms of the immune system

Q32 Bio, a Cambridge, Mass., startup developing a monoclonal antibody that blocks interleukin 7 (a cytokine in the adaptive immune system), announced this morning that it had raised $46 million in Series A financing led by Atlas Venture.

In the process, STAT's Elizabeth Cooney reports, the company also revealed plans to build fusion proteins that tamp down the activity of complement, a key player in the innate immune system’s surveillance of pathogens that can turn rogue.

“Our approach is all about restoring balance — or homeostasis — to both adaptive and innate immunity,” said Michael Broxson, CEO and co-founder.

Read more.

In the process, STAT's Elizabeth Cooney reports, the company also revealed plans to build fusion proteins that tamp down the activity of complement, a key player in the innate immune system’s surveillance of pathogens that can turn rogue.

“Our approach is all about restoring balance — or homeostasis — to both adaptive and innate immunity,” said Michael Broxson, CEO and co-founder.

Read more.

June could be big for IPOs

Global market turmoil has made biotech IPOs fairly scarce, with only 14 for the year so far. But all that could change in June thanks to a spike in potential offerings.

Seven biotech companies have filed to go public in recent weeks, angling to raise about $800 million combined. The first is Pliant Therapeutics, focused on fibrotic diseases, expected to begin trading next week. Behind it are Burning Rock Biotech, Avidity Nanomedicines, Generation Bio, Vaxcyte, Legend Biotech, and Royalty Pharma.

The major biotech indices have been volatile in recent days, hitting all-time highs in early May before slumping on concerns that coming up with a coronavirus vaccine might not be as straightforward as investors apparently assumed. That creates an awkward entry point for the latest IPO hopefuls, as factors well out of their control will dictate the sentiment around biotech for the next few weeks.

Seven biotech companies have filed to go public in recent weeks, angling to raise about $800 million combined. The first is Pliant Therapeutics, focused on fibrotic diseases, expected to begin trading next week. Behind it are Burning Rock Biotech, Avidity Nanomedicines, Generation Bio, Vaxcyte, Legend Biotech, and Royalty Pharma.

The major biotech indices have been volatile in recent days, hitting all-time highs in early May before slumping on concerns that coming up with a coronavirus vaccine might not be as straightforward as investors apparently assumed. That creates an awkward entry point for the latest IPO hopefuls, as factors well out of their control will dictate the sentiment around biotech for the next few weeks.

Wall Street is already spending Sanofi’s money

On Monday, Sanofi said it planned to sell off a roughly $13 billion stake in Regeneron Pharmaceuticals. And, within hours, Wall Street had drawn a familiar conclusion: The company is about to buy something big.

The biggest beneficiary, in stock price terms, was BioMarin Pharmaceutical, which rose as much as 10% on Tuesday. Kennen MacKay, an analyst at RBC, pointed out that Sanofi will be sitting on more than $20 billion in cash once its liquidates its Regeneron shares, which would be roughly enough to buy BioMarin at a 30% premium, giving the French pharma giant a bigger share of the rare disease market. Furthermore, the company restructured its agreement with Regeneron in order to sell the stake sooner, which suggests some immediacy.

But any reading of the tea leaves should consider an alternate possibility: Sanofi is selling now because Regeneron is suddenly really valuable. The company is among the many drug developers working on a treatment for Covid-19, and, accordingly, its stock price has risen more than 50% on the year. It’s entirely feasible that Sanofi sped up its divestiture because Regeneron looks to be peaking, not because it has an acquisition in sight.

The biggest beneficiary, in stock price terms, was BioMarin Pharmaceutical, which rose as much as 10% on Tuesday. Kennen MacKay, an analyst at RBC, pointed out that Sanofi will be sitting on more than $20 billion in cash once its liquidates its Regeneron shares, which would be roughly enough to buy BioMarin at a 30% premium, giving the French pharma giant a bigger share of the rare disease market. Furthermore, the company restructured its agreement with Regeneron in order to sell the stake sooner, which suggests some immediacy.

But any reading of the tea leaves should consider an alternate possibility: Sanofi is selling now because Regeneron is suddenly really valuable. The company is among the many drug developers working on a treatment for Covid-19, and, accordingly, its stock price has risen more than 50% on the year. It’s entirely feasible that Sanofi sped up its divestiture because Regeneron looks to be peaking, not because it has an acquisition in sight.

More reads

- A pharma effort to work with European officials to develop needed drugs is a ‘failure.’ (STAT Plus)

- Biotech tourists drive short-lived rallies in Covid-19 stocks. (Bloomberg)

- Sarepta CEO: Office may 'become an anachronism' as remote work upends the biotech industry. (Business Insider)

- Experts push for a ‘seal of approval’ to improve the quality of medicines (STAT Plus)

.png)

No hay comentarios:

Publicar un comentario