Generic Competition and Drug Prices

New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices

Greater competition among generic drug makers is associated with lower generic drug prices, according to a new analysis using two different sources for wholesale prices. We show that generic drug prices after initial generic entry decline with additional competition using both the average manufacturer prices (AMP) reported to the Centers for Medicare and Medicaid Services (CMS) and invoice-based wholesale prices reflecting pharmacy acquisitions from IQVIA’s National Sales Perspective database (NSP). Estimates using AMP show price declines associated with additional generic competition steeper than those based on invoices for pharmacy acquisitions, though most of the difference comes from wholesaler markups.

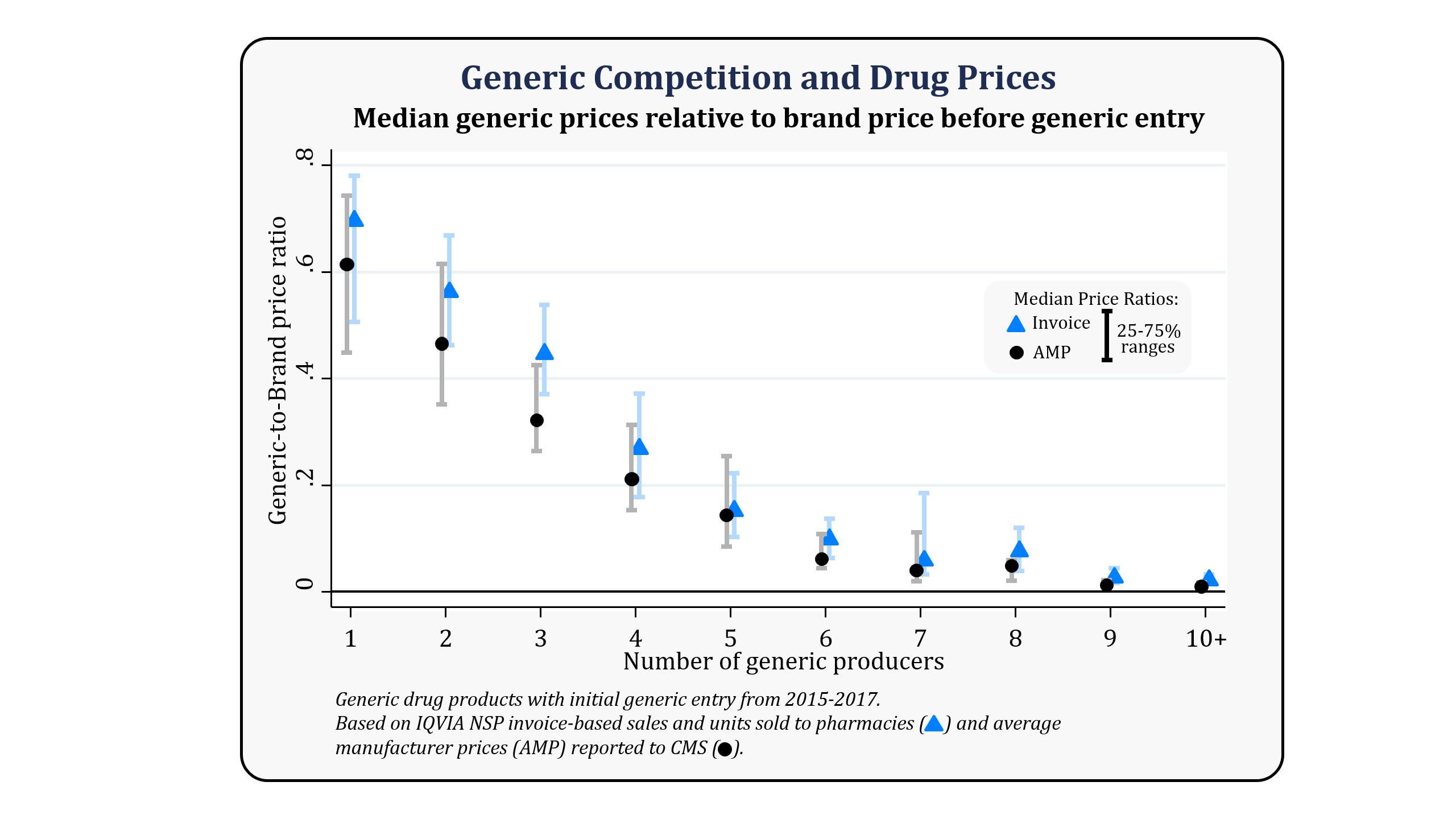

The figure below presents our analysis of prices and competition for all drug products that had initial generic entry between 2015 and 2017, showing median generic-to-brand price ratios and their ranges by the number of generic producers.

We find that for products with a single generic producer, the generic AMP is 39% lower than the brand AMP before generic competition, compared to a 31% reduction using invoice prices. With two competitors, AMP data show that generic prices are 54% lower than the brand drug price before generic competition, compared to 44% when calculated using invoice-based drug prices. With four competitors, AMP data show that the generic prices are 79% less than the brand drug price before generic entry, compared to 73% when calculated using invoice-based drug prices. With six or more competitors, generic prices using both AMP and invoice prices show price reductions of more than 95% compared to brand prices. Combining all competition groups, we find median price of generics relative to brands using AMP is 40% for the drugs in our sample, while the median price ratio using invoice prices is 49%.

This analysis builds on earlier FDA work comparing generic and brand drug prices and follows related studies. 1,2

The complete report discusses these results in more detail and also provides additional information on the data and methods used: Generic Competition and Drug Prices: New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices (PDF-828KB).

.png)

No hay comentarios:

Publicar un comentario